The smart Trick of Personal Loans Canada That Nobody is Discussing

The smart Trick of Personal Loans Canada That Nobody is Discussing

Blog Article

Personal Loans Canada Fundamentals Explained

Table of ContentsNot known Incorrect Statements About Personal Loans Canada The Basic Principles Of Personal Loans Canada Some Known Factual Statements About Personal Loans Canada The Definitive Guide to Personal Loans Canada5 Easy Facts About Personal Loans Canada Shown

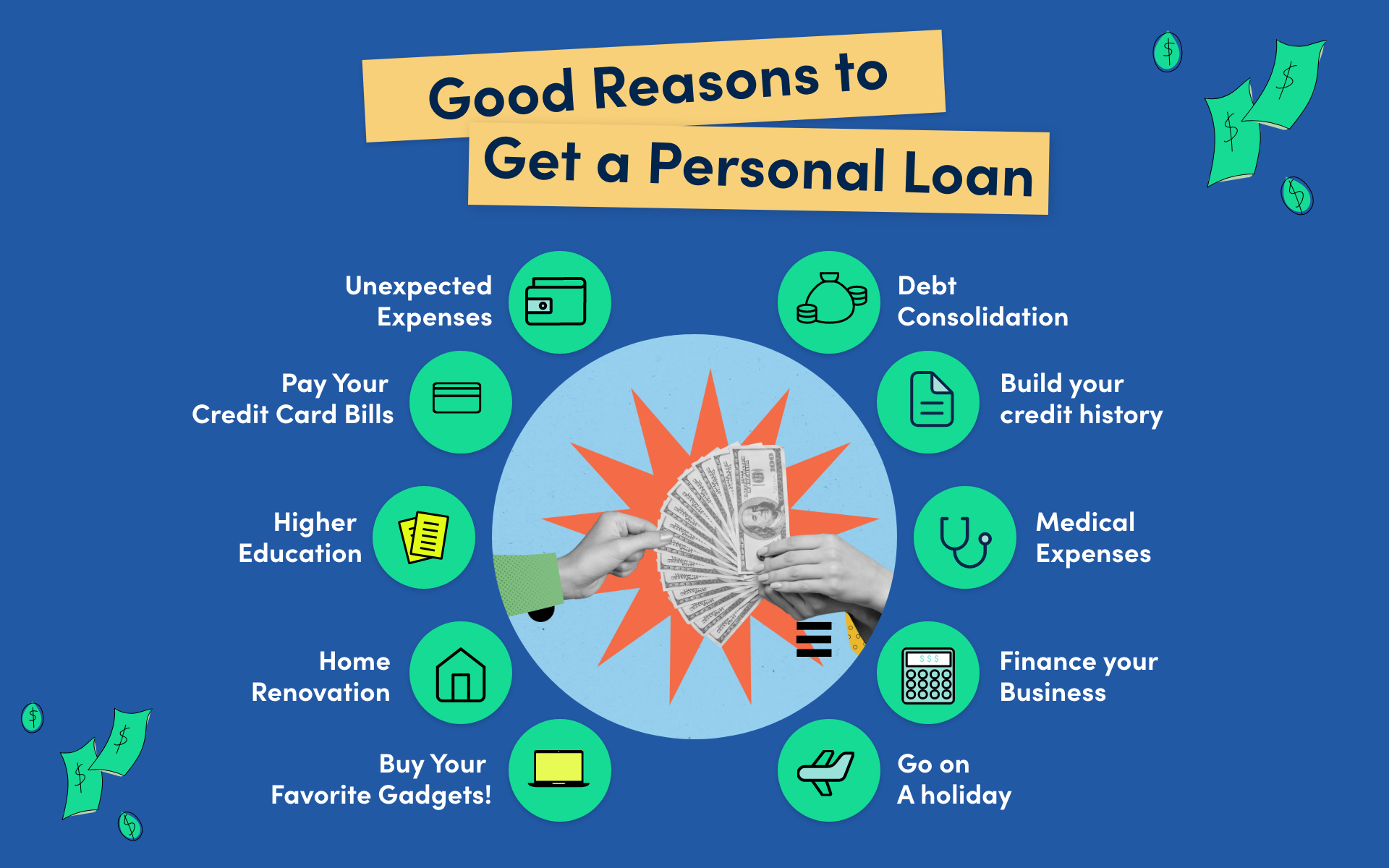

Let's dive into what a personal financing in fact is (and what it's not), the reasons individuals use them, and exactly how you can cover those insane emergency situation expenditures without tackling the concern of financial debt. A personal loan is a round figure of money you can obtain for. well, nearly anything.That doesn't consist of borrowing $1,000 from your Uncle John to assist you pay for Christmas provides or allowing your roomie spot you for a pair months' rental fee. You shouldn't do either of those things (for a number of factors), yet that's practically not an individual loan. Personal finances are made through a real economic institutionlike a bank, credit history union or on the internet lender.

Allow's take a look at each so you can know specifically just how they workand why you don't need one. Ever before. Many personal lendings are unsafe, which implies there's no collateral (something to back the funding, like an auto or home). Unprotected lendings generally have greater passion rates and call for a much better credit rating because there's no physical product the lending institution can take away if you do not compensate.

The Single Strategy To Use For Personal Loans Canada

Stunned? That's alright. Despite exactly how good your credit is, you'll still have to pay interest on a lot of individual finances. There's constantly a price to spend for obtaining money. Secured individual fundings, on the various other hand, have some type of security to "safeguard" the car loan, like a watercraft, precious jewelry or RVjust among others.

You could likewise obtain a secured personal lending using your vehicle as collateral. That's a harmful action! You don't want your major setting of transport to and from work obtaining repo'ed because you're still paying for in 2015's kitchen area remodel. Count on us, there's absolutely nothing protected concerning safe fundings.

Just because the repayments are predictable, it doesn't indicate this is a great bargain. Personal Loans Canada. Like we claimed before, you're pretty a lot ensured to pay interest on an individual car loan. Just do the math: You'll end up paying means extra in the future by obtaining a lending than if you 'd just paid with cash money

What Does Personal Loans Canada Do?

And you're the fish hanging on a line. An installment lending is an individual loan you pay back in repaired installations in time (generally when a month) up until it's paid completely - Personal Loans Canada. And do not miss this: You have to pay back the original funding amount before you can obtain anything else

Don't be mistaken: This isn't the exact same as a credit report Click Here card. With personal lines of credit history, you're paying passion on the loaneven if you pay on time.

This one obtains us provoked up. Due to the fact that these services prey on individuals who can't pay their costs. Technically, these are short-term loans that provide you your paycheck in advance.

The 7-Minute Rule for Personal Loans Canada

Due to the fact that points get real unpleasant genuine quickly when you miss out on a settlement. Those creditors will certainly come after your sweet granny who guaranteed the funding for you. Oh, and you must never guarantee a lending for anyone else either!

But all you're truly doing is making use of new debt to pay off old financial obligation (and prolonging your lending term). That just suggests you'll be paying much more in time. Business recognize that toowhich is specifically why numerous of them provide you debt consolidation financings. A reduced rate of interest doesn't get you out of debtyou do.

:max_bytes(150000):strip_icc()/Personal-loans-111715-final-3c39d6d214e44604bdc1efca2525d37d.png)

And it starts with not obtaining any type of more money. ever before. This is a good general rule for any kind of economic acquisition. Whether you're thinking about obtaining a personal lending to cover that kitchen remodel or your frustrating credit score card expenses. do not. Obtaining debt you could try these out to spend for points isn't the way to go.

Not known Facts About Personal Loans Canada

And if you're taking into consideration a personal finance to cover an emergency, we get it. Borrowing money to pay for an emergency situation only intensifies the stress and anxiety and hardship of the circumstance.

Report this page